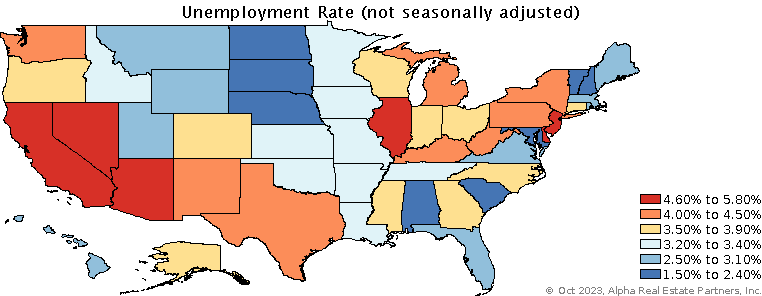

3.80%

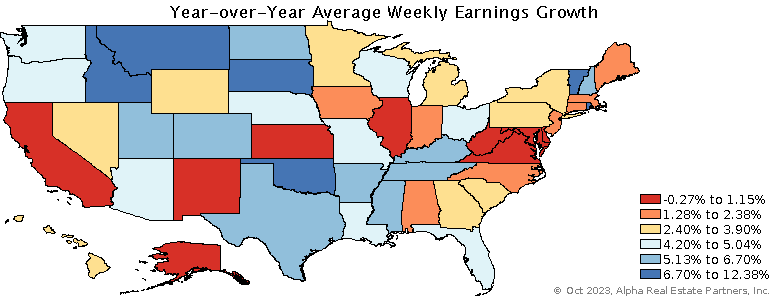

19.10%

62.80%

$1165

3.80% of the workforce is unemployed, which is

more than one year ago and an indication of a weakening economy.

Read the Bureau of Labor Statistics’ Employment Situation press release for more in-depth analysis.

19.10% of the unemployed have been out of work for 27 weeks or longer which is

more than one year ago and an indication of a weakening economy.

62.80% of the population is participating in the labor force, which is

more than one year ago and an indication of a strengthening economy.

See the BLS’s Labor Force Characteristics for more analysis.

The average weekly earnings of full-time workers is

$1,165 ($60,605 annualized) which is

higher than one year ago and an indication of a strengthening economy.

See the BLS’s Usual Weekly Earnings press release for more analysis.

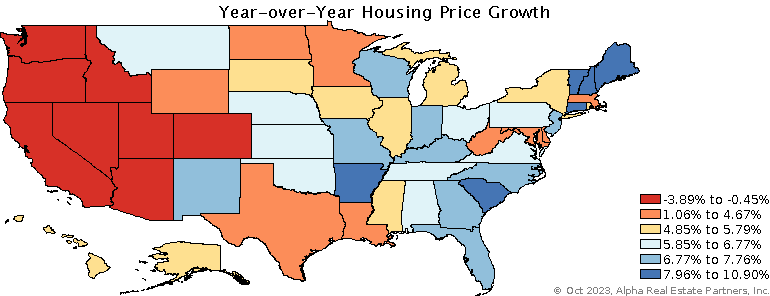

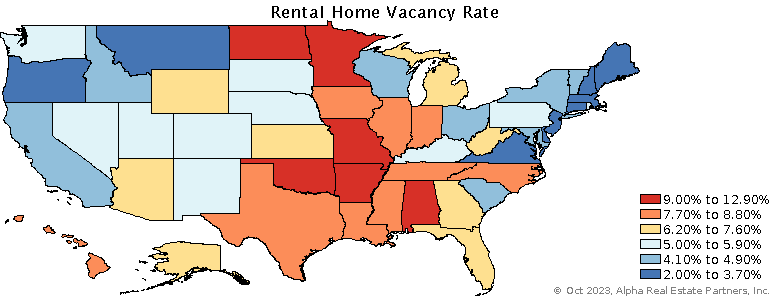

2.05%

.63%

3.89%

6.90%

6.00%

.90%

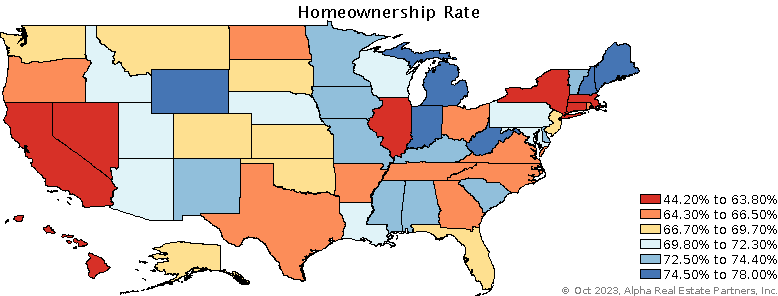

66.00%

more than one year ago.

higher than one year ago.

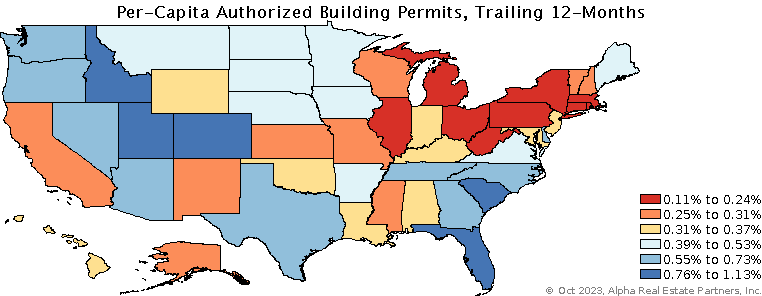

84k

47k

3.05%

12-month Average:

73,201

37,919