Conventional wisdom seems to hold that rising interest rates are good for mortgage-related investments (such as ETFs). The rationale for this is based on several concepts:

- Rising interest rates reduce refinance activity, which therefore reduces prepayments and maintains the level of interest income earned by the underlying mortgage portfolio.

- The net interest margin earned by the portfolio increases. This effect is most pronounced with floating-rate mortgage portfolios as the underlying interest income rises and keeps pace with the increasing cost of capital of the fund.

These arguments intuitively make sense to us and are the basis of many financial models for both mortgage ETFs and mortgage-backed securities.

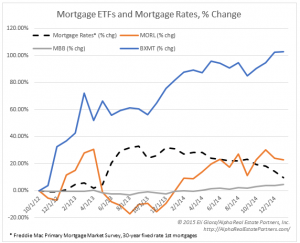

It seems reasonable to me that we should be able to test this interest rate theory by looking at the historical correlation between rates and the stock price of various mortgage-related instruments. For this analysis we will choose one ETF, MBB (iShares MBS ETF), one ETN, MORL (UBS ETRACS Monthly Pay 2x Leveraged Mortgage REIT ETN) and one REIT, BXMT (Blackstone Mortgage Trust). We compare each of these to the 30-year fixed mortgage rate.

The chart included below compares the percent change in rates and stock prices since October 2012 (the earliest date available for MORL). We can clearly see that there is little-to-no correlation between rates and these securities – which is completely against our expectations!

The reason for this observed behavior differs in each case and is actually quite simple in the case of BXMT. This REIT originates commercial mortgages indexed to LIBOR. Since 2012 there has actually been a strong negative correlation between movements in the mortgage rate and LIBOR. Before you choose to invest in BXMT you can ignore mortgage rate forecasts but you will need to study LIBOR carefully.

MORL is designed to provide twice the performance of the Market Vectors Global Mortgage REITs Index. One quarter of this index’s holdings are comprised of NLY (Annaly Capital Management Inc.) and AGNC (American Capital Agency Corp.). Annaly and American Capital primarily invest in Agency mortgage-backed securities (securities for which the principal and interest payments are guaranteed by a US government agency or sponsored entity). MBB is designed to track an index of investment grade Agency mortgage-backed securities. Though not immediately obvious, these two securities are tracking essentially the same underlying assets. Structural differences (such as ETF vs. ETN, leveraged vs. non-leverage) make these very different investments but their underlying behavior will be driven by the same fundamental forces. It seems likely to me that the performance of the Agency MBS sector has become somewhat decoupled from the macro mortgage interest rate. A quick look at MBS pricing data from FINRA’s TRACE shows a slow but steady uptick in the pricing of various MBS asset classes. This behavior is being driven by investors shifting out of other asset classes, such as corporate debt, and is driving the returns of MORL and MBB.

All-told, the lesson here is a simple one: we must not forget to research the construction of the underlying portfolios. It is quite clear that there is little correlation between mortgage rates and the performance of these three mortgage securities. It’s also clear that these three securities behave very differently from each other. If you plan on adding mortgage exposure to your portfolio don’t forget to do some fundamental research!

This article was originally published March 4, 2015 at Seeking Alpha.

Download the data used in this analysis.